Sending your kid off to college is a major milestone. Pride, excitement, and all those logistical nightmares that come with housing are the top of the list for many a family. The cycle of each year’s dorm fees and pricey off-campus apartments can start to feel like money just disappearing into thin air. So it’s no surprise, that more and more parents here are taking the bull by the horns and choosing to buy a home for their student rather than rent.

Buying, as a solution to immediate housing needs, and simultaneously building long term equity in the process, really can’t be beat. However, as soon as you decide to go the buying route, the next big question is: When on earth is the right time to make the move?

Timing it right can make all the difference between getting caught up in a frantic bidding war in the spring, and scoring a smooth as silk deal in the winter. Whether you’re looking near NC State, Duke, or UNC-Chapel-Hill, understanding the local market and being on top of the academic calendar is the key to getting good value for your cash.

Buying for a College Student Is Both a Home and an Investment

When you buy a home for your college student, you’re not just locking up a roof for them, you’re also putting money into a very healthy and strong real estate market in the Research Triangle. Raleigh and its surrounding areas are a special case, anchored by top notch universities and a thriving economy that makes for a stable environment for real estate growth.

What with all these benefits, it’s little wonder that more and more families are opting to buy. You get to lock down your monthly housing costs for the next four (or more) years, shielding yourself from those annual rent hikes that can be such a gut punch. Something else that’s a big plus is that with a mortgage, you’re not throwing money at a landlord, you’re building up your own equity. By the time your kid graduates you may have a nice wad of cash built up, especially if you rent out some of the bedrooms to roommates. Working with a real etstae team like us at Emily Weems, Realtor, will help make all this less of a headache for you.

Best Time of Year to Buy a Home for Your College Student

Now while the spring market gets a lot of attention, it’s not always the best time to get the best price. For families planning a purchase for the upcoming academic year, there’s a lot more to the game than just the spring.

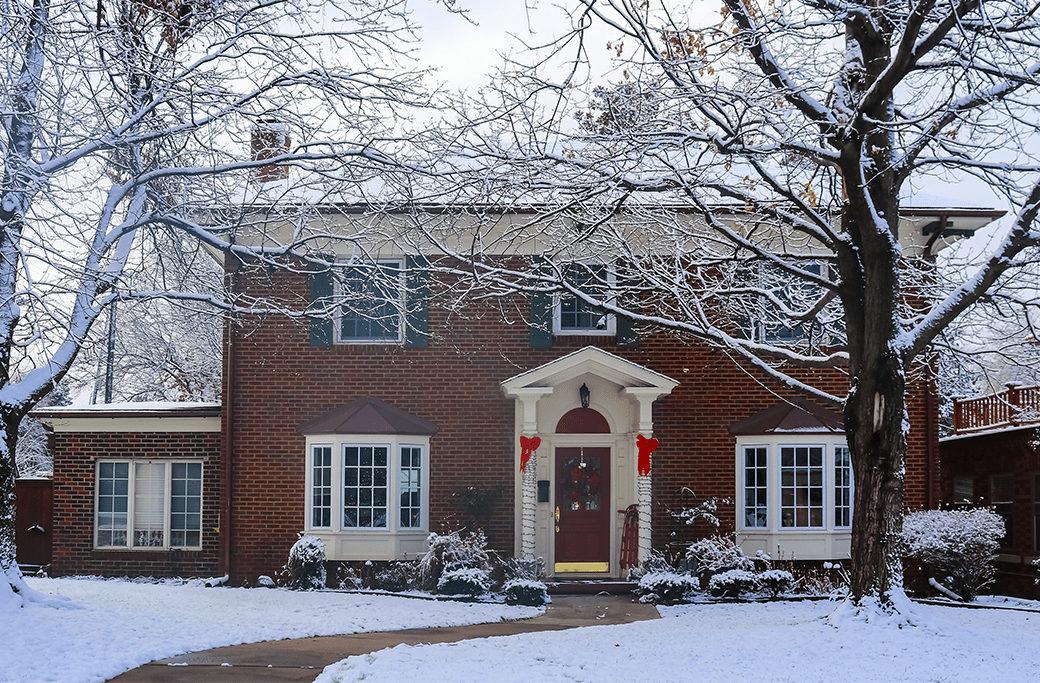

Why Late Fall & Winter Really Are The Sweet Spot

Contrary to all the conventional wisdom, the few months between late fall and winter are actually your best bet when it comes to buying a home for your student.

-

- Less Competition: Most of the usual homebuyers are bailing out for the holidays, which means fewer bidding wars and less pressure to make a hasty decision.

- More Desperate Sellers: The people who put their homes on the market in Nov/Dec/Jan usually have a pretty compelling reason to get out, so be prepared to negotiate on price and repairs.

- Time for a Makeover: Buying in the winter gives you plenty of time to repaint, fix up or furnish the place before your student needs to move in for the fall semester.

How the Calendar Can Help

Understanding the way the real estate market works in Raleigh, can give you a leg up on making the most of your investment

-

- Spring: This is the season when all the top players are in the game and prices are at their peak so be prepared to bid aggressively if you buy now.

- Summer: This might seem like a good time to get in, but with all that competition, you can end up scrambling for a good deal and high prices are not uncommon.

- Fall: The market is starting to soften ath this time, which makes it a great time to find deals on good homes as the traditional buying season winds down.

- Winter: Overall, this is the smartest financial move you can make, especially if you plan ahead.

Timing Your Home Purchase Around College Enrollment Cycles

Real estate and college calendars aren’t always on the same page, so forward planning is a must

Planning for the First Year

Ideally, you should start looking for a home for your student about 6-12 months before they’re due to start, so you can wrap up all the deals before the summer rush. If your kid starts in August, starting your search the previous winter allows you to close on a property in the spring, giving you one less thing to stress about

Upperclassmen and Transfers

If you’re buying for an upperclassman or a transfer student, you have a bit more flexibility, and since mid-year enrollment often fits perfectly with the best buying markets of the year, you might find yourself having that much more wiggle room in your purchase plans.When you’re buying a home for your college student, you need to think beyond the purchase itself. You also have to think about the exit strategy. Are you planning to hold onto this place for the four years of college, or are you looking to sell it off once the degree is in hand? If you’re going to sell it after graduation, you want to make sure you’ve picked a neighborhood with a high resale value. If on the other hand you plan on renting it out, then you’ll want to look for something that’s going to hold up to wear and tear and is close enough to campus so that students will be willing to pay top dollar.

Getting a Grip on Raleigh Market Conditions

The Raleigh market is a dynamic beast, but it’s heavily influenced by the university ecosystem.

Timing is Everything

In the neighborhoods around NC State or Meredith College, you’re going to see a big surge in listings in late Spring because that’s when all the graduates are moving out. However, that can be a tricky time to buy. If demand is high, you might find yourself in a bidding war. Knowing the local realtor who knows the ‘pocket listings,’ the houses that are coming on the market but haven’t been listed yet, can be a real advantage.

Right Neighborhood is Key

Not all neighborhoods are created equal when it comes to student housing. If you can get a house within walking distance of campus, that’s going to be the ticket. The demand for houses in those areas is always going to be high. However, you alsoneed to think about resale value down the road. Some neighborhoods are more student than anything else, while others are kind of split with families and professors. The latter tends to hold its value a bit better, but you may have to deal with more restrictive HOA rules.

Should You Wait for the Interest Rate to Drop?

We get asked this one a lot – “Should I just wait for the interest rates to drop?” The answer is… it’s a valid question, but sometimes waiting for the perfect rate can end up costing more than just getting on with it.

Hidden Cost of Waiting

There’s a trade-off between house prices and interest rates. When interest rates go down, demand usually goes up, which drives house prices up. So, if you wait for that 1% drop, you might find yourself paying $20 or $30,000 more for the same house, just because there’s more competition. Sometimes it’s just better to get the house at a lower price, and then refinance later if interest rates come down.

There are Alternatives

You don’t have to be at the mercy of what the interest rates are doing. There are a few strategies that can help.

-

- Rate Locks: Lock in a rate while you’re still looking for a house so you can’t get caught out by a sudden spike in rates.

- Adjustable-Rate Mortgages (ARMs): These can start off at a lower rate, which might be perfect for a four or five-year hold.

- Seller Concessions: If you’re buying in the slower winter months, you can sometimes negotiate with the seller to pay for a ‘2-1 buydown’. That effectively lowers your interest rate for the first two years of the loan.

Turning A College Home Into A Smart Investment

The secret to buying student housing is the ‘kiddie condo’ strategy (which really applies to single-family homes too).

How to Make the Numbers Work

If you buy a 3-bedroom or 4-bedroom house, your student can live in one room while roommates pay rent for the others. Often the rental income from roommates can cover your mortgage payments, which helps teach your student some valuable lessons in property management. And of course, it also helps pay for their education.

What to Do After Graduation

Once the degree is in hand, you have options. You can sell the house and make a tidy profit, or you can hang onto it. The demand for student housing isn’t going to disappear overnight. You can carry on renting it out, or use it as a second home for football weekends. Either way, you can enjoy a steady income and tax benefits.

How Emily Weems, Realtor, Can Help You Buy With Confidence

Buying student housing is a bit of a minefield – unless, that is, you have an expert on your side.

Local Knowledge

We know this area like the back of our hand. We know the popular streets for students, which HOAs allow rentals, and which zoning laws are in force. That means we can steer you clear of buying a house that looks great on paper but turns out to be a lemon.

Personalised Timing & Market Strategy

We don’t believe in a one-size-fits-all approach. We take into account your student’s enrollment date, your financial goals, and the current market conditions. That way we can work out a custom timeline that balances affordability with long-term value.

Start-to-Finish Guidance

We’ll be with you every step of the way from initial consultation to closing on the deal. From helping you connect with the lenders that cater to investment loan clients to sorting out inspections and repairs, we have our hands on the heavy lifting. We also try to get you thinking a few steps ahead, advising on what a property’s resale value might be worth even before you start making an offer.

Buy Now or Wait? Best Time to Buy for a College Student in Raleigh

Okay, we know the calender says autumn and winter are good seasons to buy because there’s less competition and sellers are more willing to sell, but the perfect moment to buy really comes down to being in the right position to do so. Buying a place in the summer just because the semester is about to start is a recipe for a stressful and pricey experience.

By getting a head start, locking down financing early on, and working with a local real estate team who knows the area, you can turn what was once just a bill into an investment that pays off. Don’t wait around for the next spring’s rush. Let’s start talking now so you can lock in a place that’s a great fit for your student’s future.

If you’re thinking of buying a home for your college student in Raleigh, give Emily Weems, Realtor a call to put together a smart plan that gets you the right place at the right time.